700 Credit rating – Will it be Good? Is it Bad? What does It Indicate?

Posted by: admin in paydayloanalabama.com+emelle nearby payday loansCredit ratings is actually good about three-hand numerical expression of the financial health and is move centered on the choices. The new FICO and you can VantageScore designs may be the one or two most well known borrowing scoring models.

When you find yourself there isn’t any greatest credit score, the higher its, the much more likely it is possible to acquire acceptance getting fund and you can credit cards. Keep reading to learn more about what a credit rating away from 700 mode, should it be good or bad score, and ways to replace your credit rating total.

Just what it means to provides a credit rating from 700

Centered on investigation from Experian, one of the main credit reporting agencies near to Equifax and you may TransUnion, an average FICO get on the You.S. as of 2021 was 704. This is a good rating. (VantageScore’s scoring method is very similar.)

For additional perspective, the 5 FICO score ranges are listed below: 300579 are bad, 580669 is actually reasonable, 670739 is actually a great, 740799 is actually decent, and 800850 is a keen “excellent” credit rating. You can’t provides a credit history more than 850.

Would it be good to possess a credit score off 700?

Yes, 700 is an excellent credit rating. That it get mode you’re in an excellent economic reputation. 700 is found on the lower end away from FICO’s good range. It is usually best if you continue boosting your get that it does not put on the new fair assortment instead.

Which have a rating away from 700 offers usage of a wide array from playing cards and you will financing, including auto loans, lenders, and personal money, which have lower rates of interest.

Exactly what handmade cards are you willing to get which have a good 700 credit score?

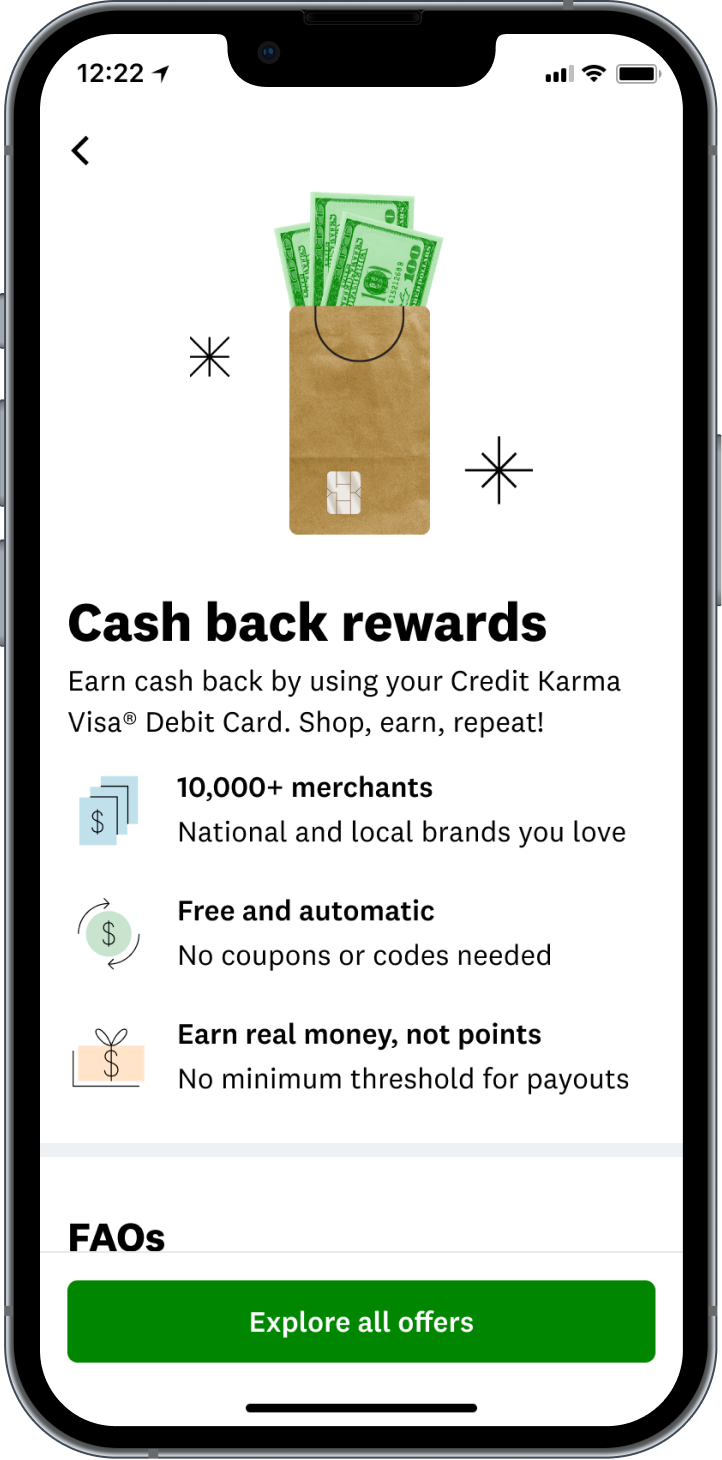

You’ll have accessibility benefits notes, however, they’ll certainly be less than precious metal otherwise diamond notes that give profiles that have as much as 6 per cent bucks-back perks. Simply people who have advanced borrowing from the bank is also discovered rare metal and you will diamond cards.

Citibank and you may Bank off The usa cards are simpler to obtain than simply Look for, Pursue, and you will Bank card. The former one or two associations be a little more forgiving when it comes to customer scores.

Keep in mind that additional factors such as your money, debt, and you will payment record can get dictate your capability to get a cards card. The reference to your local bank can take advantage of a job, also, given that that have a verifying otherwise checking account otherwise mutual history speaks into commitment and you will precision as the a buyers.

Tips alter your credit history

This is basically the most significant facet of your own rating, bookkeeping to have thirty five per cent of your computation. Skipped or later repayments on the month-to-month stability otherwise a fantastic credit credit financial obligation might be harmful, particularly if which behavior lasts, so usually shell out promptly. Doing so makes it possible to prevent interest or a lot more penalties.

The easiest way to ensure that you dont skip a repayment due day is by creating automated money or providing notifications.

It is possible to add rent and energy payments on borrowing statement. This type of costs dont generally appear on their report, you could fill out a request to provide them. If you have proper fee background, this will improve your score.

Borrowing usage is the second most crucial aspect of the get, bookkeeping to have 30 %. Credit use identifies simply how much you happen to be utilizing your cards. Maxing aside your credit and surpassing your own offered borrowing limit often negatively impact the rating. You will find your current application otherwise equilibrium on your credit card report.

Just how long you had the borrowing membership makes up about 15 per cent of your own get. This includes each other the new and you can dated membership. Banking institutions and other lenders consider this to be part of your get to find out if you’re able to create credit through the years from inside the a responsible fashion.

It’s better to save profile discover in lieu of closure him or her given that you’ll be able to beat the experience with the they, an excellent or bad, along with your credit rating you will definitely get rid of.

New credit membership applications make up 10 percent of rating. After you get a mortgage otherwise another type of https://www.paydayloanalabama.com/emelle/ mastercard, a challenging inquiry occurs. Card issuers and you may lenders request pointers surrounding their rating as part of one’s evaluation techniques.

Several tough inquiries contained in this a brief period can harm their rating, and they remain in your own declaration for two decades. Never get whatever arrives. It is strongly suggested which you rest to own half a year or maybe more prior to submitting a unique account application.

You can even seek advice into the individual credit rating statement. This might be a delicate inquiry, and cannot effect their get. You happen to be and additionally eligible for a no cost credit file one per year off any of the significant bureaus, you can also demand one to out-of AnnualCreditReport. Being told regarding your credit pays, so make sure you stay cutting edge.

Your borrowing from the bank combines make up ten percent of the score plus. Banks and you may lenders want to see your capable carry out multiple types of borrowing from the bank for example a student-based loan, revolving borrowing instance credit cards, or auto costs.

The conclusion

The greater your credit score was, the more options you have got to reach your financial desires. Again, there’s no finest credit rating, nonetheless it never ever hurts to be effective into broadening it. According to just what rating platform you use, the rating differ.

What that collector takes into account good may differ away from another, but a get from 700 or even more informs banking companies and you may loan providers that you’re not a large risk to utilize.

The realm of profit and you may borrowing may sound daunting, but having the best gadgets will help you manage your money. That big product to look at is PointCard.

Section is actually engineered since the a transparent, easy-to-have fun with option commission cards that enables cardholders to work out financial freedom and purchase their particular money because they wanna. All users located exclusive gurus, in addition to endless bucks-back and incentive cash-straight back into subscriptions, dinner birth, rideshare properties, and you can coffee shop purchases. You don’t have a credit score from 850 so you’re able to reap the fresh new rewards you need.

Alongside the thorough perks program that aims so you’re able to generate your riches, Area is sold with multiple precautions that can help it can save you and you may protect you to definitely wealth, as well. Vehicles local rental and you can cellular phone insurance rates, journey cancellation insurance coverage, scam coverage which have zero responsibility, two totally free Automatic teller machine distributions per month, with no interest rates are merely a few of these enjoys.

Zero credit assessment is needed to sign up Area. Already, Section won’t make it easier to enhance your credit rating, but it will probably make it easier to care for good credit if you are dealing with your own most other economic circumstances and you can handling your finances.

Entries (RSS)

Entries (RSS)