Auto Agent Financing: Exactly how a smooth Credit assessment Throws the consumer on Right Auto

Posted by: admin in clickcashadvance.com+installment-loans-ca+sacramento payday loan no credit check lenderTo possess a customer which have bad credit, selecting another type of car should be a tense creating. He needs to find something sensible, however, he also does not want multiple dealerships carrying out difficult borrowing inspections you to definitely negatively impact their already faster-than-beneficial credit history. When he in the end discovers an automobile the guy believes he’ll be able to finance, your customer crosses his fingertips and hopes an affirmation was on the horizon – which have a good interest.

One to larger ways you can help your customers is through doing a mellow credit score assessment rather than a painful one to because they are nevertheless on the looking stage of purchasing a motor vehicle. This can give you each other a glimpse into simply how much the guy would-be approved to have, well before dealing with the financing phase regarding the purchasing techniques. A silky credit score assessment will also help the brand new sales person cope with the fresh new conversion techniques reduced.

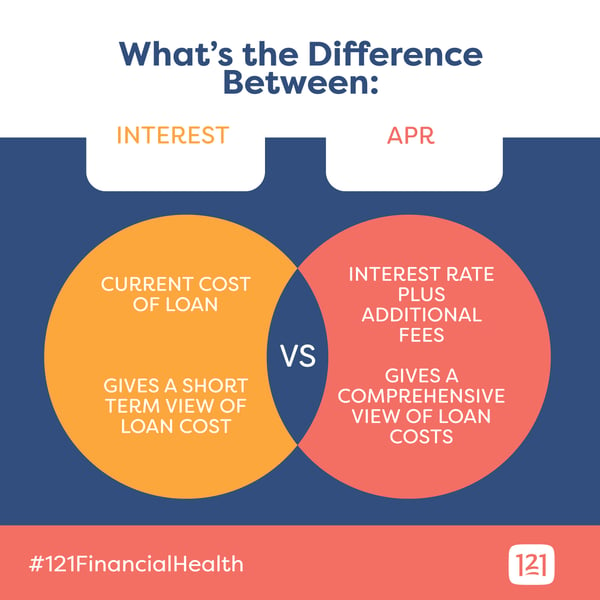

Difficult query against. soft inquiry

A painful inquiry is needed whenever a customers is able to pick an auto because credit check usually decide whether otherwise not a credit line would-be longer. In addition it find the pace the consumer shall be offered. An arduous query stays for the one’s credit report for a couple of age and will maybe possess a negative effect on credit score.

A delicate inquiry is more away from a fast history check. Permits you to evaluate economic chance before the consumer establishes to try to get a personal line of credit – its eg a pre-acceptance. A silky inquiry does not have any effect https://clickcashadvance.com/installment-loans-ca/sacramento/ on a consumer’s credit score.

While you are a challenging inquiry is when a customers are proactively applying to possess a line of credit (it naturally need it a certain automobile), a silky query is the better if buyers remains hunting.

As to the reasons a smooth credit check is key to finding the right automobile

Your following customer might walking onto the lot just in case he is able to push aside for the a unique automobile, or perhaps not have sensible criterion on which he is able to and you may are unable to afford. He along with may possibly not be an informed at money government otherwise life inside the function. It might come given that a shock to help you him in the automobile broker money work environment as he learns one his fantasy vehicle actually aligned together with truth loans condition.

not, some other consumer aged his borrowing try, but demands a reliable car to make the journey to performs to make sure that they can pay down his personal debt. He might become really anxious on coping with a salesman, since any ping to their borrowing, for example a difficult inquiry, will place your at risk even for taking an auto loan.

A flaccid credit score assessment will provide you with a look on just what your own customers’ credit is like, and you’ll be capable enable them to put a budget that produces experience. Once they know what they can manage, suggest to them auto one match what they’re finding and you may what they pays. Of the discovering that sweet spot right from the start, the complete vehicle hunting feel is much simpler – plus it guarantees your potential customers push from the package throughout the best automobile, instead of destroying their borrowing.

Exactly how AutoRaptor can deal with a softer credit assessment

AutoRaptor has actually married having 700Credit, a prominent source of credit rating and conformity choice towards automobile business. The salespeople can create a delicate credit score assessment regarding within the application, using only the customer’s term and you can target. This new brief have a look at allows the salespeople to keep some time and totally understand how far financial support the buyers might be approved getting whenever referring time to make a purchase.

Of the doing a soft credit score assessment first – and you will trying to explain to your prospects the reason why you be this will help to him or her in the long run – you can make trust and show that you are not only on it while making sales. A smooth inquiry was a way to tell you customers your admiration its borrowing and you should make sure it hop out the supplier in a vehicle that is right in their eyes. It is a win for everybody involved.

Entries (RSS)

Entries (RSS)