Our home loan application process into the Southern Africa

Posted by: admin in cashadvancecompass.com+installment-loans-tx+san-diego how much can you get on a payday loanPost conclusion

- Getting a home loan is a vital step up new property processes. Providing prequalified will help by providing you a stronger thought of what you are able afford, that will change your possibility of acceptance.

- Your chances of mortgage recognition have decided because of the, around whatever else, the personal credit record and size of your own deposit.

- Your goal is always to safe a home loan with due to the fact low interest rates that one can.

- ooba Mortgage brokers, Southern area Africa’s prominent financial comparison solution, helps make the processes simpler by applying so you’re able to several financial institutions on the account, researching home loan deals to find the best one for you.

Acquiring a home loan the most extremely important methods towards protecting the new house. After you have got your residence financing approved, you really can inhale a sigh out of recovery, knowing the vital part of the family-to get processes might have been properly complete.

That is not to say around may not be a great many other files to help you indication and additional fees to invest, but home loan acceptance is truly the best mission. Very, how do you begin achieving this? We offer a run down of the property loan application processes.

Step one: Rating prequalified

It is really not mandatory, but providing prequalified is highly advised. It gives you having a sensible idea of what you could pay for, so you’re able to wade household google search with rely on knowing what your own finances is actually. This will improve your likelihood of approval. More 90% out of home loan software submitted that have a keen ooba Home loans prequalification is recognized.

You can prequalify sometimes from the getting in touch with good prequalification professional, otherwise by using ooba Domestic Loans’ on the internet prequalification unit, the text Indication. This provides you with a fast and you may member-friendly prequalification sense.

The offer to acquire

Before applying to possess a mortgage, you find your house you would like, and then you and also the merchant signal the deal buying, an agreement between visitors and provider which stipulates requirements to-be met into both parties.

The deal to shop for want to make allotment on the best way to receive the necessary funding, even though keep in mind the offer to shop for you will tend to be a good 72-time condition, which means the seller can always industry the house or property and you will, whenever they receive a better render, offer 72-hours’ observe to get your facts in check and give a wide berth to shedding out on the home.

So as soon because you signal the deal to find, you ought to run obtaining home loan right away, very you will have the cash in order to right back the acquisition.

Obtaining the house loan

This will be it, as soon as from knowledge, for which you make an application for a home loan in the financial – usually a lender – to purchase price of getting the family.

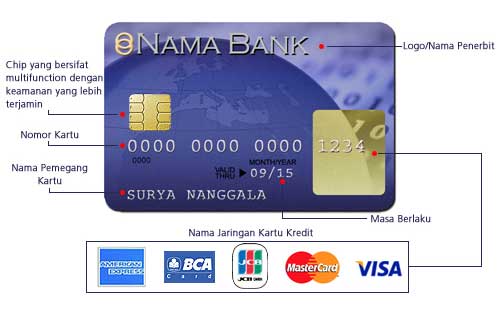

What files do i need to sign up for a mortgage?

- Bring to purchase

- Name file

- Newest payslip

- half a year straight payslips in the event that payment/overtime try attained

- Current 90 days lender comments

The length of time does it need to possess a financial so you can agree a good mortgage within the Southern Africa?

Today simple fact is that waiting to see if your property financing gets acknowledged. This will usually take up to one week, though it would be postponed in the event the applicants are not able to satisfy certain criteria.

- Your credit rating: The new single most important factor. This really is an effective about three-digit amount that says to the financial institution how much cash out of a danger youre. It’s based on studies of your credit history, including payments due installment loans San Diego TX, credit taken out and the like. Before applying for home financing, you need to do what you are able to pay off the personal credit record. A credit score a lot more than 600 provides you with a very good threat of financial recognition.

Entries (RSS)

Entries (RSS)