Just how Friend Financial Compares Against Almost every other Lenders

Posted by: admin in cashadvancecompass.com+personal-loans-oh+ottawa bad credit loans no paydayThe next step would be to fill in the called for paperwork, which generally takes one to two weeks to complete. In this step, you are able to performs directly together with your financing coordinator to gather, comment and you will indication all papers and you will models you need. Don’t forget that this can all the happen online and across the mobile phone, since the Friend doesn’t have bodily metropolises. These documents constantly were present shell out stubs, employment records, taxation statements, proof of most other earnings otherwise assets, divorce case preparations, proof of student loan repayments and much more. Your loan coordinator will additionally set you up that have an appraisal team.

The loan planner could keep your updated while in the this step

Next happens this new underwriting procedure, whenever Friend looks at and you can verifies all of the documents you have sent when you look at the. And here the final decision on the acceptance is created. While approved to possess a home loan, you will see regarding your rate and you will mortgage name possibilities. Like that, you can constantly understand where the job and you can home loan solutions stand.

If you’ve managed to get this much, your future step are closure go out! This is how you speak to your own home and you will closure representatives to examine and you can indication their closing data. Anticipate to pay your own settlement costs, as well as your advance payment, at this time.

Contained in this 15 months immediately following closure, Ally have a tendency to contact one allow you to to let you know who will service the loan. You would not end up being and work out your mortgage payments directly to Friend. Instead, you are able to improve payments into loan servicer. Brand new terms of your loan will still be lay by Friend, whom you can invariably experience of concerns or issues about the financial.

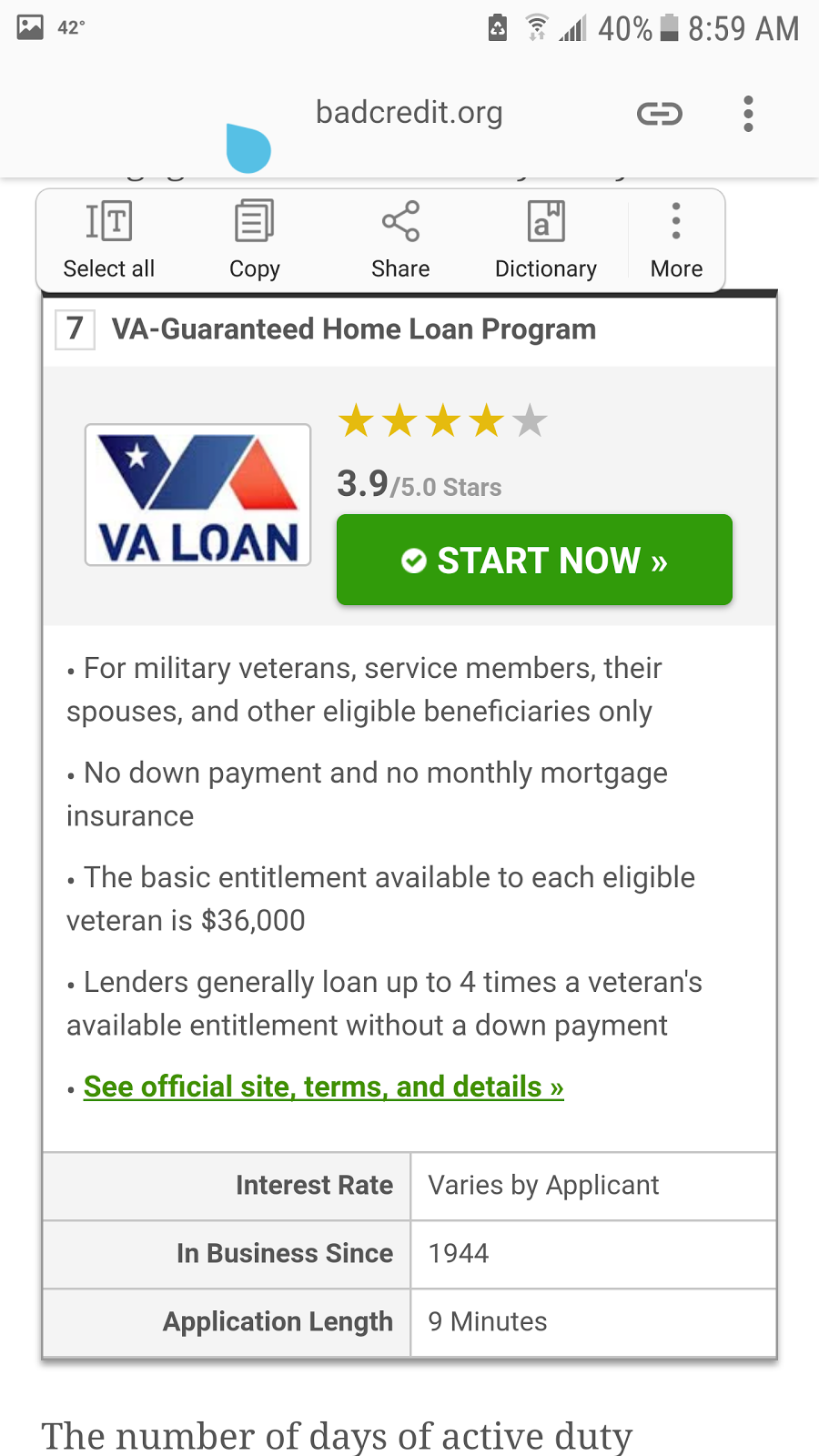

When it comes to mortgage loans, Ally pledges aggressive cost and you may options for anyone. Think of you will need to possess a credit rating out-of in the minimum 620 in order to be eligible for a home loan with Friend. You need to keep in mind that Ally Lender does not render any regulators-supported home loans today. Including Virtual assistant, USDA and you may FHA financing. So if you’re seeking a great Va, USDA or FHA loan, you’re going to have to discover a unique mortgage lender.

Beyond these types of limitations, their Friend House People deals with you to find the best financial option for you, the money you owe and you will needs. Because of every step of the procedure, you will have a person in the house Class at the rear of and you will assisting you to on ins and outs of real estate. In addition can choose if you might rather end up being called from the mobile phone otherwise current email address.

Of course, remember that Friend works entirely on line. If you are you have constant use of the application, accounts and you may coordinators, this may all take place over the telephone or email and you may never actually. If that’s something you need regarding a home loan bad credit installment loans Ottawa OH company, you might reconsider that thought dealing with Friend.

Several of Ally’s competition regarding home loan room that offer such beneficial money

An advantageous asset of working with Ally for your home loan was your business is the full-service standard bank that gives bank accounts, credit cards and you may financing alternatives. If you would like to keep all your valuable economic issues which have a good single institute, this may be an enormous confident for your requirements. You will find positives and negatives with lenders and eventually merely you could potentially choose what is the ideal complement both you and your unique financial predicament.

Refinance: If you aren’t content with the regards to your existing financial, you do have a choice of refinancing your residence financing. Refinancing relates to changing the definition of period of your own mortgage and you may/or even the interest rate of one’s mortgage. You can switch their financial away from fixed rate to help you an Arm and vice versa.

If you have a product which you qualify for and therefore are trying to find, your house Mortgage Mentor may then offer a great pre-qualification page. So it page will let family sellers know you happen to be intent on to invest in property. The page will tell just how much you’ll be able to borrow out of Friend. It is vital to know that when you’re Ally allows you to through the the process, you also have duties yourself-to shop for techniques. You’re going to have to manage your own Ally Family People by responding their calls and you can getting all of the needed and you will honest guidance to find the best efficiency. This will help one another oneself and you can Friend to stay inside during the the whole process.

Entries (RSS)

Entries (RSS)