Benefits and drawbacks Off A keen FHA Mortgage And just why It Matters

Posted by: admin in paydayloanalabama.com+riverview how much can you get on a payday loanWhen you need to become a homeowner, odds are you’ll want to remove home financing. Whilst you you certainly will shoot for a traditional mortgage loan using any number of loan providers, you might imagine looking into solutions, eg federally supported loans such as the FHA (Federal Casing Expert) financing. But envision all of the experts together with potential cons of financial options, in addition to that from a keen FHA mortgage, before you apply.

What is actually An FHA Financing?

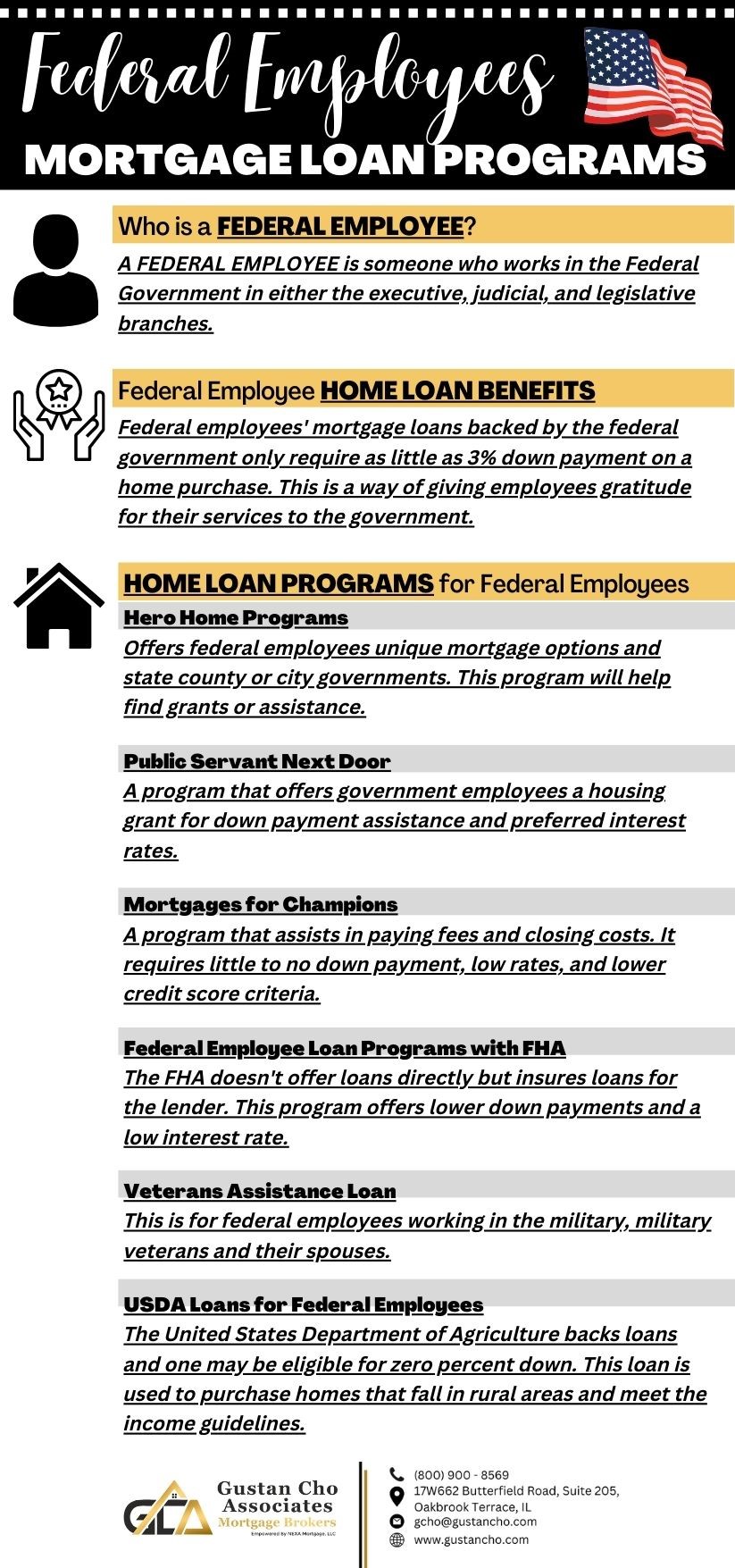

FHA funds try money backed by the federal government. He could be provided thanks to recognized loan providers and you can qualifying is easier due to the fact he’s insured of the bodies. FHA financing make it borrowers who may not have eligible for an effective conventional mortgage to locate a mortgage. The risk try shorter for loan providers exactly who topic FHA fund, therefore if a borrower non-payments on their FHA financing, the financial institution was covered due to the fact FHA money was insured of the the federal government. Keeping that in mind, FHA financing are a great selection for individuals exactly who may not feel the strongest economic info.

Advantages of Brand new FHA Loan

Individuals can find that there are many other pros so you can taking out an FHA financing together with the ease within the being qualified. They’ve been the following:

Your credit history Choices

Loan providers see the credit history off consumers to decide exactly how financially in control and how financially able to he’s of fabricating loan costs promptly plus in complete. One of the most key elements of one’s credit file try the credit get, which provides loan providers with an overall look at how creditworthy a borrower is actually. For antique lenders, really loan providers need borrowers getting a credit score regarding from the minimum 640. Credit history conditions are much less restrictive with regards to FHA funds. Individuals who possess a credit rating of five hundred otherwise significantly more than usually still be eligible for a keen FHA loanand those having a credit history with a minimum of 580 will manage to supply restriction resource.

Something different lenders see whenever getting your credit score is your debt-to-money ratio. This shows her or him how much cash you will be making rather than exactly how much obligations you’ve got. Whether your personal debt-to-earnings proportion is just too large, might determine that you will never have the ability to accept so much more financial obligation thru home financing. The best personal debt-to-money ratio typically accepted by loan providers towards a conventional mortgage was 43%, while they would make up specific other factors while looking on a great borrower’s personal debt-to-earnings proportion as well, such as anything reserves they may features including large credit ratings. With FHA money, the most personal debt-to-earnings ratio acknowledged is 50 percent (counting the borrowed funds).

Financing Rates

The loan-to-well worth (LTV) proportion is the level of the mortgage counted resistant to the actual worth of the house (determined by an expert assessment of the property). The actual ratio is actually computed of the splitting the loan number from the the fresh new residence’s appraised well worth. The latest LTV is dependent on exactly how much of a down-payment you create and assists loan providers to determine simply how much regarding an effective exposure the borrowed funds merchandise. The higher the LTV try, the greater number of regarding a threat the loan is deemed. For traditional funds, the new LTV limitation is often 95 percent. But not, to possess FHA funds, the newest LTV restrict is 97 per cent. Thus FHA will funds a more impressive amount borrowed.

Reasonable Rates

One of the greatest great things about FHA loans is that the interest recharged into the mortgage is similar no matter exactly what your credit rating is. FHA money can save you way too much money on the financial attention in comparison to antique loans, and this legs their attention prices into various things, along with the size of regarding a downpayment you will be making too just like the exactly how large your credit rating is.

Cons To be familiar with

Getting consumers who have had some financial difficulties throughout the previous, an FHA financing might seem including an unbelievable replacement an excellent antique loan. Although not, though an enthusiastic FHA mortgage has its own express off professionals, there are possible downsides that you need to be aware of. Listed below are some of the disadvantages out of a keen FHA loan:

With respect to just how long you only pay away from the financial, FHA financing just bring a few period choice15-season and you will 29-12 months words. Regardless if 15-12 months and you may 29-season terminology are definitely the common to possess conventional mortgage loans, they often times bring more alternatives such as 10-12 months, 20-12 months, as well as forty-season terms.

Rigid Conditions and requirements

FHA money keeps much stricter standards and requires toward kind of away from property you could potentially purchase. Such, the new FHA won’t fund any attributes which have electricity, architectural, foundational, plumbing work, or wires circumstances. A home inspection is needed therefore the standards for that check could be way more strict than the a normal financial, which has no review criteria.

From the limits, additionally, it ensures that you cannot buy an excellent fixer-higher into intention of renovating or repairing factors on your own. The seller need to manage any facts discovered during the assessment or new FHA won’t agree the mortgage. This may be also difficult when there is more than one buyer on domestic: the seller is more browsing deal with offers from some body using a normal mortgage simply because they won’t have to look at the stress of conference this new FHA’s standards.

Restricted Loan Choices

There are numerous types of antique lenders you may take away, however, just a limited level of FHA money. You can easily just be able to take-out an enthusiastic FHA financing to own owner-occupied residences. You simply can’t have fun with a keen FHA loan to own next land, belongings, otherwise money services, and you may only choose from repaired-rates and one changeable-speed program.

Restrictions into Loan amount Anticipate

You could potentially sign up for home financing to possess an expensive domestic in the event that a loan provider deems your creditworthy. But not, if you submit an application for a keen FHA mortgage, know that you’ll find limitations about how exactly far money you is also borrow secured on FHA funds. Financing constraints create are very different a small regarding county so you can county centered some dough out of traditions. Mortgage constraints and additionally rise frequently to keep up with this new cost of living. In the 2019, the loan maximum threshold is actually $726,525 inside the high-cost components, just like the floors try $317,827.

Entries (RSS)

Entries (RSS)