To open a keen IDA, you ought to find an enthusiastic IDA program close by and you will satisfy particular qualification conditions

Managing home may appear such as a hopeless dream, or you get individual your house and you will love dropping it – in both cases, you can find apps which can help you having homeownership:

- Down-payment and you may financial software makes it possible to pick property.

- The Section 8 homeownership system can help you having mortgage payments with the a property when you’re currently leasing having fun with a section 8 casing choice coupon. Read the rest of this entry »

Whenever you are prepared to make the leap to your storage space your data files, pictures and much more about affect but need assistance deciding and that provider is useful to your requirements and you will purse, we’ve got your wrapped in all of our inside-breadth affect shops investigations.

Sarah Mitroff is an elder publisher getting CNET, handling our health, exercise and you can health posts. She actually is authored to possess Wired, MacWorld, PCWorld, and you cash advance out of New Hope Alabama may VentureBeat.

Space the files on affect has some pros. You will see your records from one cellular telephone, pill otherwise desktop that’s attached to the Web sites, while the cloud may also give content getting data files so they never drop off if for example the cell phone will get shed or your computer or laptop crashes. Utilizing the affect was a zero-brainer, but selecting and therefore provider to make use of is a bit more challenging. Read the rest of this entry »

The bank could well be responsible for pretending simply on the men and women information sent as a result of Sites Financial that are actually received

The financial institution will not assume obligation for any malfunctioning inside interaction institution maybe not less than their control that will change the reliability otherwise timeliness out of messages you send

Disclaimers: The information, you assess out of this simulator, is intended for usage on your part once the techniques merely; this is not a deal and has now no courtroom impression. Financial One to allows zero responsibility for any loss as a result of one the means to access or dependence on people data or findings reached having fun with the newest calculator.

- Our travel

- Our Annual reports

- Sign up All of us

- Help Middle

- Opinions & Grievances

- Grievances Plan

- Exchange rates

- Shopping

- Private

This web site is owned and you may run of the Financial You to definitely Minimal and you may the use thereof mean that you take on brand new Bank’s Conditions and you can Conditions useful.

The bank get, in the the entire discernment, when and you will without notice, customize otherwise posting such as for example Fine print of use. Including changes would be effective instantly and also you can be considered to possess acknowledged same for individuals who continue using the website.

While the Lender efforts to incorporate right information about its Web site, it does not bring one promise display or meant about the accuracy, completeness and you can precision. Read the rest of this entry »

LendingTree makes testing-looking brief and you can seemingly painless, simply because of its streamlined loan consult procedure

Proper seeking to receive a mortgage, refinance, and take away a house guarantee mortgage, collecting quotes out-of multiple lenders is extremely important. Users will find away whether they qualify for a loan, and you will what the terminology is, in about normally date because requires to help you fry an egg.

And because you’re certain providing numerous offers back to back, you can test so you can haggle that have loan providers on the hopes of dropping the interest rate or decreasing the closing costs. You can just have a much better mortgage bring than the main one with which your already been.

LendingTree and you will Credit Pub

Despite the much the same names, LendingTree and you will Credit Pub are a couple of completely separate agencies. Lending Pub was a peer-to-peer on the internet lending system in which personal investors affect borrowers and does not offer mortgages. LendingTree is largely an online suggestion service having multiple mortgage activities as well as mortgages.

LendingTree Disadvantages

LendingTree offers many perks, and individuals whom know how to benefit from this new solution may indeed disappear with a far greater home loan price than simply they will possess received because of the handling just one financial.

Yet not, using LendingTree comes with a couple of downsides. Probably the biggest anger spoken because of the LendingTree people is that they avoid upwards flooded that have calls and you can characters. The individuals mortgage officers enjoys a big economic bonus to make new business of every borrower lead they contact. Read the rest of this entry »

Financial 2, situated in Oklahoma City and you can belonging to brand new Chickasaw Nation, is brashly comparing by itself on biggest mortgage brokers in the country – behemoths such Lender out-of America, Wells Fargo and Arizona Common Financial – when it comes to Native mortgage regularity.

Tucked Secrets: Red-colored Cloud requires top honors from inside the discovering boarding school prior

According to material it delivered at National Indian native Housing Council courtroom symposium here, brand new $70 million in property Lender 2 is probably the no. 1 Company out-of Construction and you can Metropolitan Invention section 184 guaranteed Native indian mortgage lender inside the Oklahoma as well as the third biggest HUD 184 financial in the nation.

Lender dos Leader Ross A good. Hill, into the a page written in order to legal symposium attendees, advised her or him “Financial dos is quick are a frontrunner when you look at the financial origination and you may delivering finance so you’re able to Indigenous Us americans in the Oklahoma in addition to country.”

The bank made $4.5 billion inside the loans so you can Natives inside the Oklahoma this present year, enjoys 77 people since the people in the country, possess assisted four tribal casing bodies in becoming approved into HUD 184 program, and it has made Indian native mortgage brokers “regarding California to Vermont, away from Florida in order to Alaska.”

When is actually predict local rental money maybe not acceptable?

Forecast local rental income isn’t necessarily appropriate for underwriting, regardless if. Firstly, you have got problems getting it counted if it never become noted (instance, if for example the lease has been paid-in cash). For the reason that lenders either consult duplicates out of inspections since research that the lease was continuously are repaid on time.

And, forecast rental income might be difficult to justify if the book is really worth less than market value. Imagine if your ily associate that have preferential rent. When it is recognized, you do not score as frequently value from it just like the you would expected. In this situation, you’ll have to use the leasing opinions intricate on lease as your estimated earnings, rather than the market price which the device normally appraise.

How your own local rental income might be determined whenever you are trying to be eligible for a mortgage varies according to brand new papers being used so you can justify they.

Just how try local rental income determined having federal tax statements?

When federal tax returns are acclimatized to assess qualifying leasing earnings, the financial institution need to create back in people subtracted expenses – decline, attention, homeowners connection dues, fees otherwise insurance coverage – to your borrower’s cash flow before performing any calculations. Read the rest of this entry »

Your own matter about how such matchmaking enjoy away indicates matter or concern with the long term

Their expect something you should trust reveals on your keenly assured the fresh matchmaking ends up so you can sense continued thrill together with time of yourself as opposed to (I am guessing) this new feared loss of sexual energies, desirability, and you can performance necessary to perception therefore live

Today, you can produce quantities about what it eroticized it is and why an aspire to become common skyrockets. As with anything else individual, there can be alot more so you can it than simply matches the interest.

Is there something you significantly worry shedding beyond it or sexual focus?

We could possibly as well as mention there is a sad tendency to marginalize or eradicate the many benefits of later years, in addition to the inescapable trouble and anxieties. Read the rest of this entry »

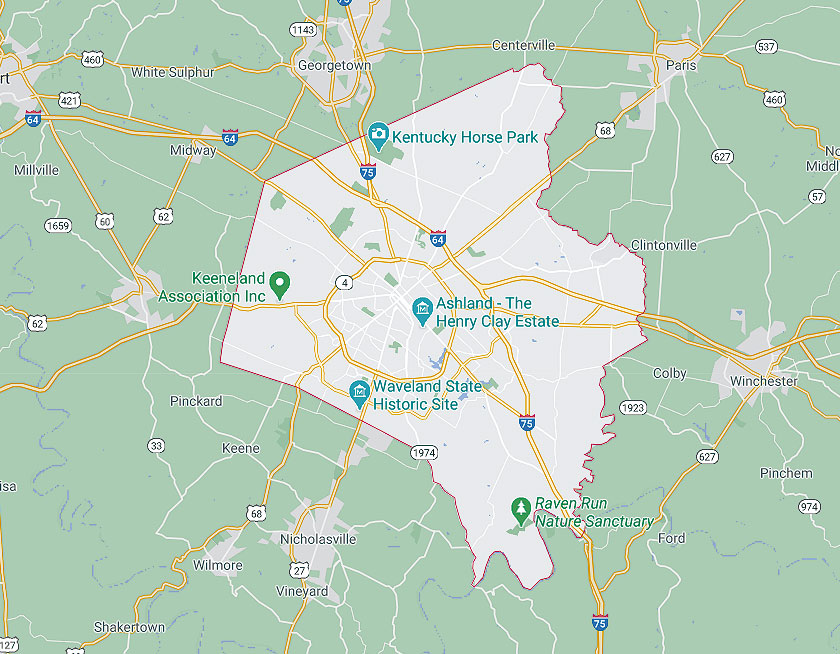

From the Atlanta area, the average household can cost you $376,100000, requiring at least earnings out of $103,100

Also Sun Belt towns, where house are less and you can new house significantly more abundant, commonly resistant to help you rates rising cost of living. Within the 2020, the fresh average house money into the Atlanta is $64,179.

How far do family cost need to slide to get him or her close at hand out-of more Us americans? Much depends, state experts, towards power of the overall economy, a position, and you can wage increases, and trajectory interesting prices. When the affordable house prices continue declining and you can inflation-modified wages increase, casing sooner or later grows more affordable.

Edward Pinto, a former exec from the Federal national mortgage association, rates one to U.S. home costs you are going to slide of the ten% on average from end out-of 2023. That is however less compared payday loan Lincoln Park to nearly forty% increase since start of the pandemic in early 2020.

For example a small modification during the prices does not bode well to own aspiring people, claims Mr. Read the rest of this entry »

The new Elective Equal Monthly installments shown about desk will be enable it to be that spend the money for matter funded in full inside the Estimated Rewards Period of 6 months, and in case (a) that it count is actually and also be the sole harmony to your account within the marketing and advertising period, And you can (b) you will be making the brand new monthly payment revealed by deadline for each and every few days And you will (c) the total amount funded are at the mercy of the fresh new relevant capital advertisements provide. Your instalments (cost) usually equal extent funded. When you yourself have any additional equilibrium in your membership, actually purchasing for each and every Optional Equivalent Payment ount Funded from inside the advertisements several months, and you can focus can be billed for you personally from the purchase go out.

At the mercy of borrowing from the bank recognition

And work out the minimal monthly installments and something finally larger benefits count in the last few days of one’s marketing and advertising period will be allow you to blow the total amount financed revealed completely into the 6 month marketing several months. Assuming: (1) this amount is actually and also be truly the only equilibrium towards membership from inside the advertising period, And you will (2) you create about their minimal payment per month because of the due day each month, And (3) the quantity financed try at the mercy of new applicable funding advertisements offer. The minimum payment required will refuse as the remaining equilibrium declines. When you yourself have any additional balances in your membership, the latest monthly payments applicable to the people balance will increase their month-to-month payment and might perception just how money is actually used on this marketing purchase. Read the rest of this entry »

HAMP falls under the government government’s Making Family Sensible system, a step made to let having difficulties homeowners who have been impacted by brand new latest economic credit crunch. Click the link to see the fresh government’s HAMP webpage to find out more. Owing to HAMP, a beneficial homeowner’s monthly premiums is actually quicker so that the fee is actually no more than 30% of the web month-to-month income. There are various away from other standards that need to be came across to qualify for a modification by way of HAMP, and it’s vital that you note that never assume all loan providers participate, even when really has actually at the very least an internal package which you P, you’ll need to be in a position to document which you have adequate money to purchase brand new commission in the event it is actually approved. Additionally, you will must have a recorded adversity to show that why you are in trouble comes from issues beyond your handle, instance jobless or earnings reduction, which the new hardship was only short-term.

The loan Modification Processes

Whenever you are thinking about obtaining a mortgage amendment, it is very important keep in mind it is far from an easy and simple procedure. It will take as long as 1 year, or more sometimes. It can be a troubling procedure, as well. You are going to need to promote data files showing your earnings, an affidavit attesting into the adversity, a current checklist of the house expenditures, recent tax statements, lender comments, and you can numerous other files that bank might require. Typically, you will end up getting this type of data on the loan carrier, not directly to the genuine bank. If this sounds like the outcome, the servicer will have to remark good “complete package” in advance of sending they into underwriting company. If you have a premier number of modification desires, which is typically the actual situation, the job may sit “complete” to possess months if you don’t weeks. Read the rest of this entry »

Entries (RSS)

Entries (RSS)